Building a 24/7 Carbon Free Energy Market

And announcing our Seed round

Why we are building WattCarbon

We know that roughly 35% of annual carbon emissions come from buildings and that about $10 trillion in fresh capital will need to be invested to decarbonize the built environment. We also know that at our current pace, we’ll not come close to meeting emissions reductions goals. Simply electrifying heating alone will require installing 20,000 heat pumps and heat pump water heaters per day for the next twenty years. At around $20,000 per project, that’s $2,920,000,000,000 (almost three trillion dollars) in space and water heating alone. Cooking, vehicle charging, gas dryers, lawn equipment, backup generators, and more will all add to the cost of decarbonization. And this is just in the United States.

Complicating this math is the fact that the primary beneficiaries of this capital investment will be our children and our children’s children. For those being asked to shoulder the financial burden of decarbonization today, the immediate, tangible benefits are hard to grasp.

We need to rethink the value proposition around decarbonization. It’s not that we shouldn’t be expecting folks to do their part to reduce their own emissions, but rather we should be thinking about decarbonization as making a collective investment into our future.

Fixing our buildings represents our greatest hope for a viable future. If we are able to eliminate the 35% of emissions from buildings, we will have probably made them more resilient to the effects of climate change. We will have made them safer, cleaner, healthier, and sturdier. We will have figured out how to produce abundant clean energy and distribute it at the times and locations that it is needed. We will have eliminated major sources of international conflict by ridding the world of petro-dictatorships. We will probably also have figured out how to grow crops in highly efficient indoor spaces, saving billions of gallons of water that will instead replenish our aquifers and reservoirs. Buildings have always reflected our cultures and our values. Now the fate of our buildings is intertwined with the fate of humanity.

Net Zero is the Right Framework for Decarbonizing Buildings

Most of the carbon emissions associated with buildings come from generating electricity and burning natural gas and other fossil fuels for heating and for industrial processes. Some of these are avoidable, others require large capital expenditures to eliminate.

When accounting for carbon emissions, Scope 1 emissions are from sources that you control directly (such as burning natural gas to heat your building) while Scope 2 emissions are from sources over which you have little control, such as the power plants that provide electricity to the buildings in which you live and work. While you can choose how you heat your building, for the most part you are stuck with your grid’s particular mix of electrons.

Scope 2 emissions are particularly hard to mitigate because they happen at power plants spread throughout your grid’s “balancing zone” and are shared equally by everyone using electricity on your grid. Over time, as the grid gets powered with cleaner electricity, these emissions will fall. But until coal plants are retired and natural gas plants are replaced with solar, wind, geothermal, and batteries, Scope 2 emissions will remain.

“Net zero” is a way around this problem. It’s a concept rooted in the democratization of clean energy development. Rather than waiting around for utilities to change their ways, energy consumers can do their part to accelerate the transition to clean energy by investing directly in the development of new renewable energy resources.

Even though a consumer may still be using the same electricity from the grid as before, by contracting for the renewable energy that is fed into the grid (either directly through a PPA or indirectly through a REC), that consumer can help reduce the emissions of the grid as a whole.

The way this is handled in carbon accounting is to differentiate between locational emissions (based on the mix of fuels of all the different power plants that provide electricity to a grid) and market emissions (based on individual purchases of clean energy). There is no “net zero” for locational emissions unless the grid runs completely on carbon free energy, but there is “net zero” for market emissions for consumers who match their energy consumption to equivalent purchases of clean energy.

Why Time and Locational Carbon Accounting is Changing Everything

Most net zero accounting today matches annual energy consumption with annual energy purchases, without regard to the time of day or location in which the energy consumed or clean energy production happens. But granular locational accounting and hourly matching opens up a massive opportunity to align clean energy procurement with full grid decarbonization.

Academic researchers have shown that the impact of renewable energy procurement is significantly enhanced when matched to consumption on a time and locational basis. Others have noticed this too. Google has announced a commitment to offsetting 100% of its data center energy consumption with renewable energy matched on an hourly basis within the same grid. Peninsula Clean Energy has announced this same goal, providing its customers with clean energy procurement that matches the aggregate load of the community. Soon, federal agencies will be required to procure power based on time and locational matching as well.

The reason hourly accounting provides such a powerful net zero framework is that it aligns the price signal of procurement with the challenge of producing clean energy at particular times of day. With annual matching, it’s easy to buy lots of cheap solar RECs and pretend that they offset nighttime consumption. But with hourly accounting, the cheap solar RECs hardly move the needle, especially in places with excess solar production during the day. By contrast, carbon free energy available when the sun is down and winds are calm is highly desirable. Obtaining coverage on a 24/7 basis means that resources like demand response and load shifting are suddenly an important piece of the clean energy mix.

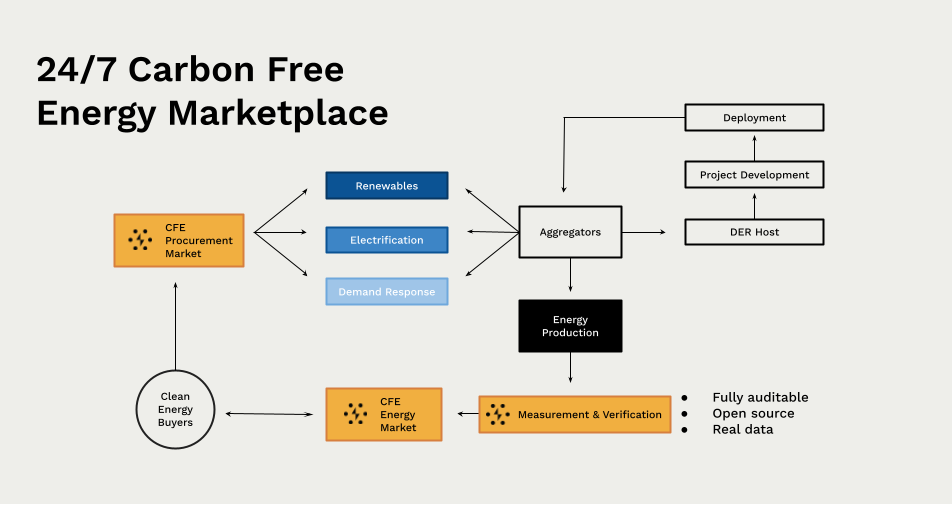

The WattCarbon 24/7 CFE and Carbon Offset Market

Today, we are excited to announce the launch of the world’s first 24/7 CFE and carbon offset market sourced from buildings and distributed energy resources. Our vision is for any company, organization, community, or individual to be able to match every kilowatt of electricity consumed, every hour of the year, with an equivalent kilowatt produced or reduced by a new energy resource through a private Virtual Power Plant (VPP). It will also be possible to match every therm of natural gas consumed with an equivalent reduction coming from an electrification project nearby.

How the Market Works

WattCarbon has partnered with some of the most ambitious decarbonization companies on the planet to provide capacity for the 24/7 CFE market. These companies have made their existing networks of resources available for CFE procurement, and where a higher bar of additionality is required, these companies can deploy new CFE resources on behalf of the CFE buyer, such that all new CFE can be claimed by the buyer as fully additional to the grid.

To participate in the market, the buyer selects from among three options of CFE resources:

Demand Response - reductions in energy consumption at particular hours of the day or shifts in load from one time of day to another.

Renewable energy - grid-connected production of renewable energy from solar, wind, or small hydro facilities.

Electrification - replacement of fossil-fuel powered heating and cooking equipment with electrical equipment

Procurement happens prospectively in the form of a forward contract for future Clean Energy Credits (CECs) that are minted from the development of new resources or retrospectively for CECs that have already been produced but are available in the market for purchase.

Prospective procurement takes the form of a Virtual Power Purchase Agreement (vPPA), or Virtual Carbon Purchase Agreement (vCPA) in the case of Electrification, where the entirety of the output of the procured capacity is supplied to the buyer.

Retrospective procurement more closely resembles a REC purchase, where a specific amount of CECs are purchased for particular hours. This type of purchase can be useful when backfilling a 24/7 CFE goal for the hours of the year in which existing clean energy contracts have failed to produce enough CFE supply to match loads.

We will be sharing more about the market in the weeks and months ahead. But before we get to that, there’s one last thing to share.

Announcing our Seed Round

We are pleased to announce that WattCarbon has raised a $4.5 million Series Seed, led by True Ventures with existing investors Village Global, Jetstream, Not Boring Capital, Keiki Capital, Rick Stratton, and Chris Vargas joined by Greensoil PropTech Ventures, Nexus Labs, and Andrew Karsh in filling out the round. We are excited to welcome Priscilla Tyler to our board and look forward to building a great company together. We are currently hiring for two software engineering positions which can be found here: https://climatebase.org/company/1132206/wattcarbon. If you’d like to help us decarbonize buildings, feel free to reach out.